With the rise of free trades and investment trading platforms in our pockets, it has never been easier or more accessible to be an owner of companies through stocks.

Overall, this has been a good shift for our economy.

But you face a unique challenge.

You already ARE a business owner. Regardless of what your Robinhood app says.

As business owners, we must decide when it is right to invest in our own companies vs investing in the broad market of companies.

I want to give you a few thoughts to chew on…

—

Why should you invest in yourself?

There is great power in investing in yourself. Namely, you control the outcomes.

Now I understand that you aren’t in complete control and that there are other factors at play.

Supply, demand, costs, labor, etc.

But you are in a position to make adjustments to your company’s strategy.

NOT crossing your fingers and hoping that the CEO of BigLots makes aggressive market moves to penetrate a new market.

BIG DIFFERENCE.

Often times, investing in yourself/your business can have the greatest ROI. Whether you see it financially or not.

—

How do you balance control and flexibility?

Control and flexibility are two sides of the same coin when it comes to investing.

Investing in your business is an example of investing with control in mind.

That being said, your business has an achilles heel. Liquidity.

An active brokerage account is arguably the most liquid way to be invested in companies.

In a moment’s notice, you can sell out of your positions and be sent cash within 2-3 business days.

That’s the epitome of flexibility.

As with anything, it is important to balance both of these with your timelines, risk tolerance, and goals.

—

Chad and Tesla

How do you maintain diversification when investing in your business? One of the most important metrics to watch in your portfolio is diversification.

Let’s take an example of Chad.

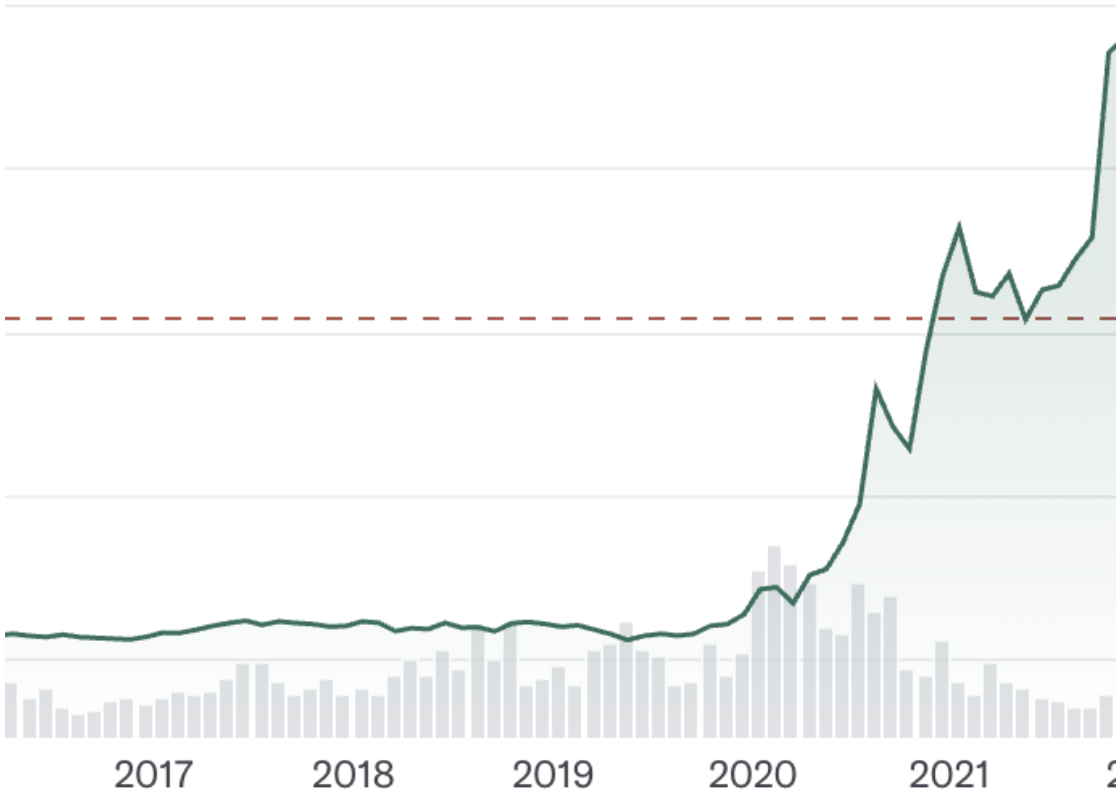

Chad heard that Tesla was the most attractive investment of his lifetime.

Chad sees this chart and gets EXCITED.

Oh my. It’s straight up and to the right.

“Tesla NEVER loses value!” he says to himself.

So he transferred his entire savings account – $3,000 – into Robinhood and bought as many shares of Tesla as he could.

Chad put all of his eggs in the Tesla basket and didn’t take diversification into account.

Unfortunately, within a year this happens:

Now, Chad’s $3,000 is worth a little over $1,000. Not fun.

Chad had no way to predict that Tesla’s stock price was going to plummet. BUT he could have protected his money by diversifying across a broad spectrum of industries.

(Chad’s example is fictitious and purely educational)

—

The same is true for investing in your business AND with investing in the stock market.

Neither is inherently better than the other.

A well diversified portfolio would include healthy mixes of both.

An ordinary financial advisor would tell you that you should only be invested in the stock market.

He wants “his” 1% fee on what you have invested.

But financial planning is never one size fits all.

You deserve a financial planner who is willing to put your goals first. Even if it means getting paid less.