Do you ever ask yourself…

Advocating for Financial Clarity

Here are 3 examples of clients we have helped.

The background: Matthew is 24 and single. He works in the real estate industry on a low salary with high commission options. Even with his income potential, he has struggled to make significant progress towards saving for his future. His main goal is to aggressively allocate money towards his student loan balance.

The background: Jordan and Macey are 28 and 25. They have one child – Olivia. Jordan owns a blue collar service based business with high income during summer months, and lower income during winter months. He has multiple contracted employees and pays himself a monthly salary. Macey is a stay at home mom.

The background: Daniel and Nicole have successfully raised 3 wonderful children. Daniel is the owner of an architecture and engineering firm. Nicole is on staff at their local church. With their kids in college and personal expenses lower than they’ve been in years, they want to make this next transition into retirement count.

You deserve a real plan.

A plan that gives you clarity.

Your financial plan gives you clarity, direction, and it highlights your purpose.

Most financial advisors might focus on how much of your investments they manage, planning for retirement, and selling you a life insurance policy (if you’re unlucky enough.)

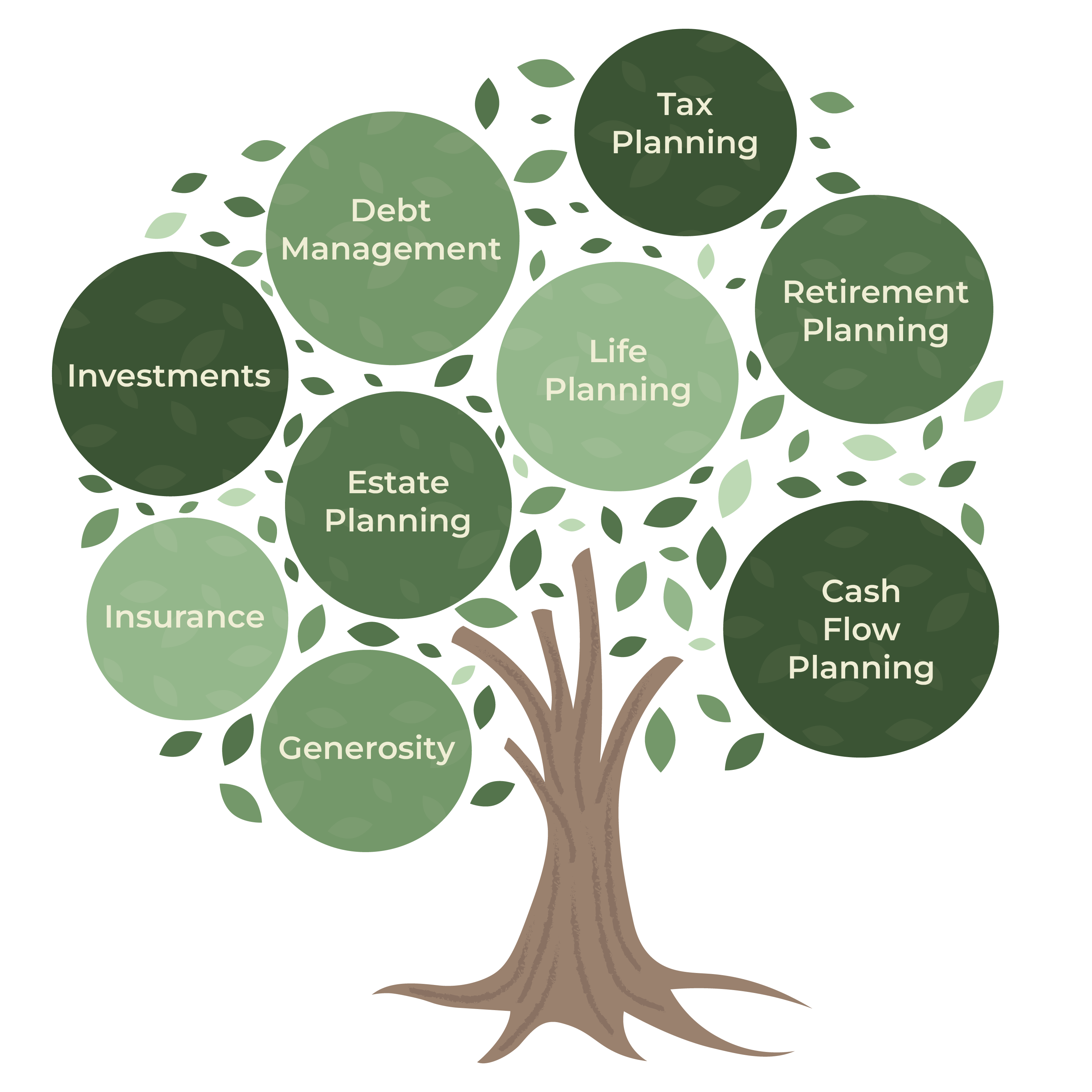

We do things differently. All 9 aspects of your financial life are important – and it matters how you mesh them together.

Meet the 9 Components

FAQs

Recent blog posts

Don’t miss a thing…

Sign up with your email address to receive education, helpful tips, and articles that are actually relevant to you.

It’s so good you won’t have to unsubscribe – but you can if you want to.